Daily TrendCompass reports deliver crystal clear market gudiance on more than 100 financial and commodities markets including crude oil, copper, gold, wheat, soybeans, coffee, cotton, Nikkei 225, S&P500, Euro, Yen and dozens of others.

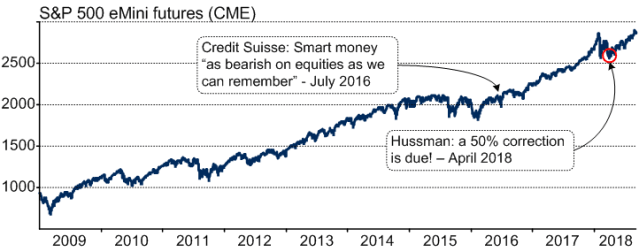

Cutting through information overload

The financial industry generates literally thousands of research reports each and every day, producing an overwhelming glut of information. Instead of adding to your reading pile, we analyse market trends and deliver to you the final product of our research: clear, executable daily decisions that will help you navigate the markets profitably, confidently and with a peace of mind.

Proven reliability, versatility and effectiveness

TrendCompass is generated by the I-System, probably the most versatile and most effective trend following model today. I-System is the product of more than 20 years of passionate and uncompromising obsession with quality and reliability. We have tested its effectiveness in the most rigorous way possible: by managing real money portfolios and comparing their performance to that of the world’s leading “managed futures” funds or Commodity Trade Advisors (CTAs). Since the inception of our track record in 2007, I-System has consistently outperformed its benchmarks.

Real-time CTA intelligence

For decades, commodities trading advisors (CTAs) have relied on systematic trend following as one of the most successful strategies in active investment trading. Many institutions like JPMorgan, Nomura and Rabobank pay close attention to the CTAs. Nomura’s analysis found that CTA net buying often triggers major market moves in equities and treasuries. Rabobank’s analysts affirmed that, “CTAs have long been key in understanding price action in commodities markets,” and that understanding CTA market flows “can provide a strong edge in today’s highly systematized markets.” TrendCompass delivers this edge – reliably and in real time!

Invaluable decision support

A reliable and effective trends auto-pilot provides invaluable decision-support. Even only as a ‘reality check’ or a source of ‘second opinion’ to market analysts, TrendCompass offers a number of critical advantages:

The value of TrendCompass reports

| Solution to imperfect knowledge | Information overload and complexity of market analysis are reduced to simple, executable decisions: buy or sell. No need to divine the future. |

| Measurable quality of decisions | Consistency and method in trading allows us to objectively measure the quality of our trading decisions |

| Discipline | Trading algorithms exclude human error like distraction and emotion |

| Absence of rogue trader risk | Rogue traders are the main cause of major trading misadventures. The risk of such mishaps is a strong deterrent for managers to explore more active approaches to trading. I-System elegantly removes this risk, replacing the human element with quantitative strategies free of human shortcomings. Like industrial robots, I-System strategies perform their tasks without mistakes. |

| Work ethic | I-System strategies never lose focus and take no days off. |

| Robust performance | I-System’s unique ability to implement multiple autonomous strategies has the same effect as diversifying trading risk among many skilled traders, raising the probability that on average they will deliver satisfactory performance. |

What you get

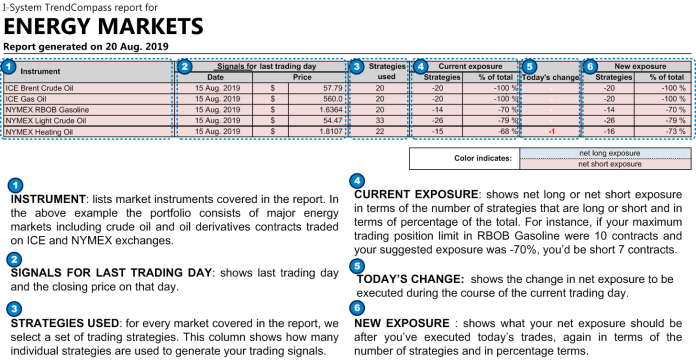

(1) Summary page

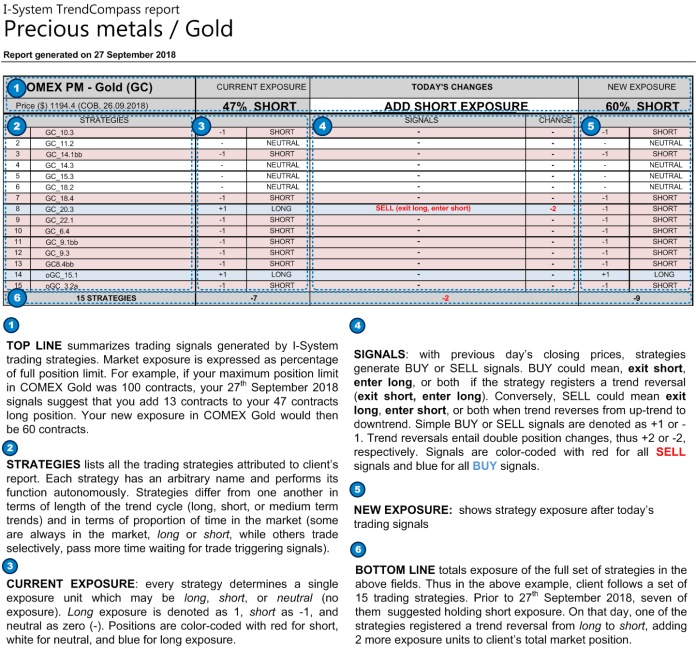

(2) Detailed strategy page per each market covered

What it’ll cost you

Subscription to TrendCompass reports begins at 500 Eur per month. For the first 100 subscribers we’ll slash that price by 12 and offer a full year’s service for the price of only one month’s subscription.

Sign up for a free trial

Link to a sign-up page.