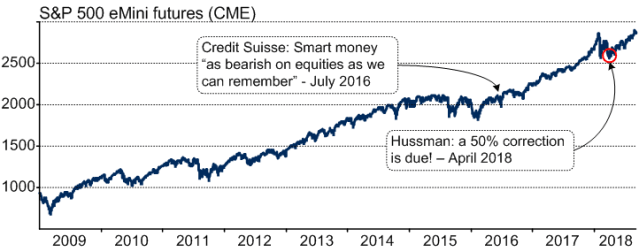

Markets move in trends. For decades, trend following has been the most effective trading strategy.

In 1997 we set out to create the best trend following model of its kind. With a passionate and uncompromising dedication to quality, we created the I-System, a dual A.I. neural network capable of deploying a virtually unlimited number of intelligent trading strategies in hundreds of global markets through guided machine learning.

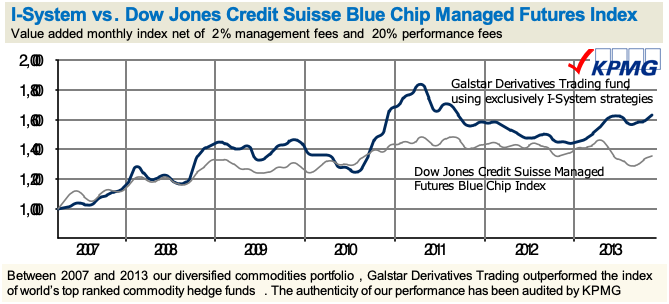

Over the years, I-System has proven supremely reliable as well as versatile and effective. Since 2003 it has functioned continuously with zero code tinkering and zero alterations of its algorithms. Since the start of our track record in 2007 it has consistently outperformed the relevant strategy benchmarks, including world’s top performing, “Blue Chip” managed futures hedge funds.

As global financial and commodities markets enter a period of deepening uncertainty and volatility, the need for a versatile, reliable and effective strategy that can deliver positive returns regardless of market cycle is an invaluable tool for corporate hedgers, traders and investors alike.

I-System – a dependable trends auto-pilot

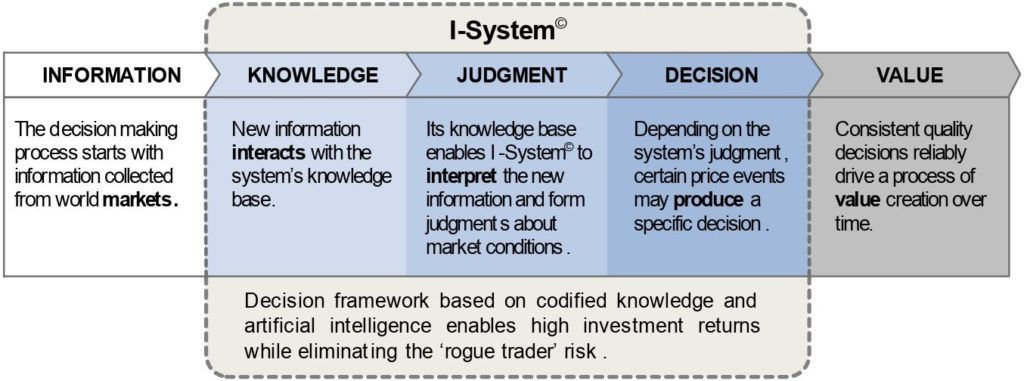

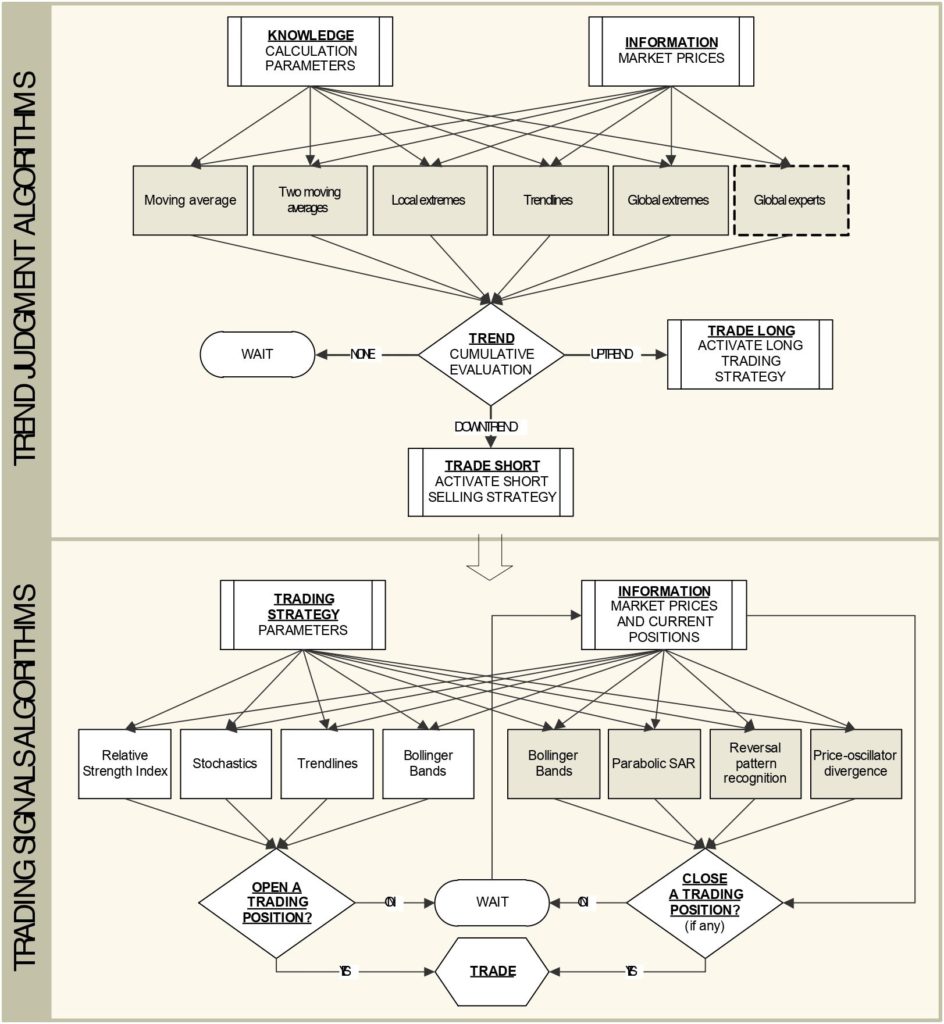

I-System is a dependable, time-tested trends auto pilot. It comprises a dual neural network of mathematical algorithms that codify a body of knowledge in market analysis and trading.

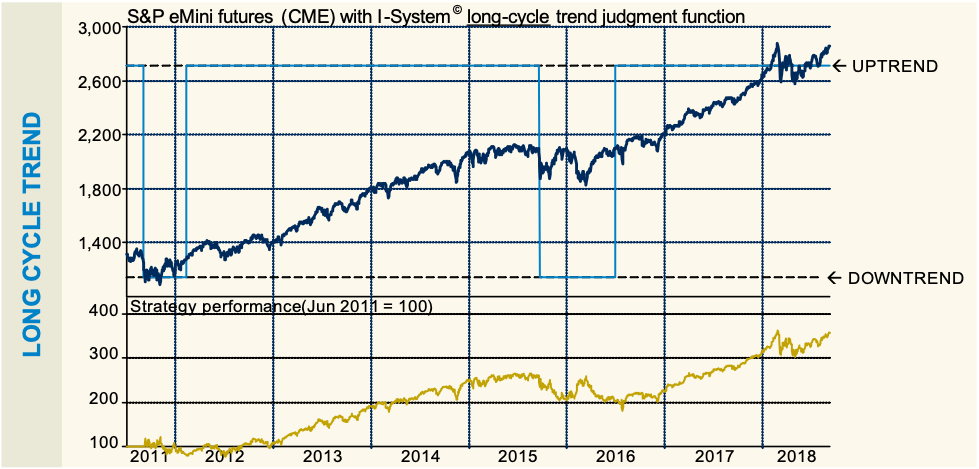

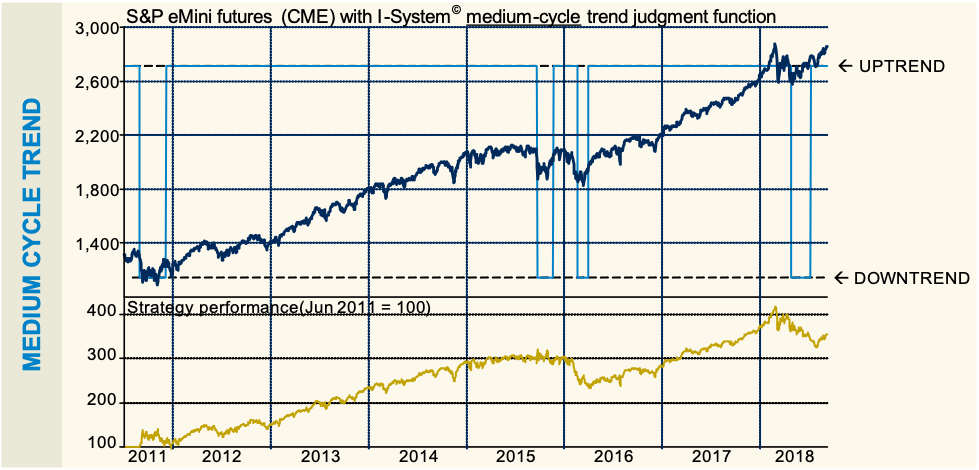

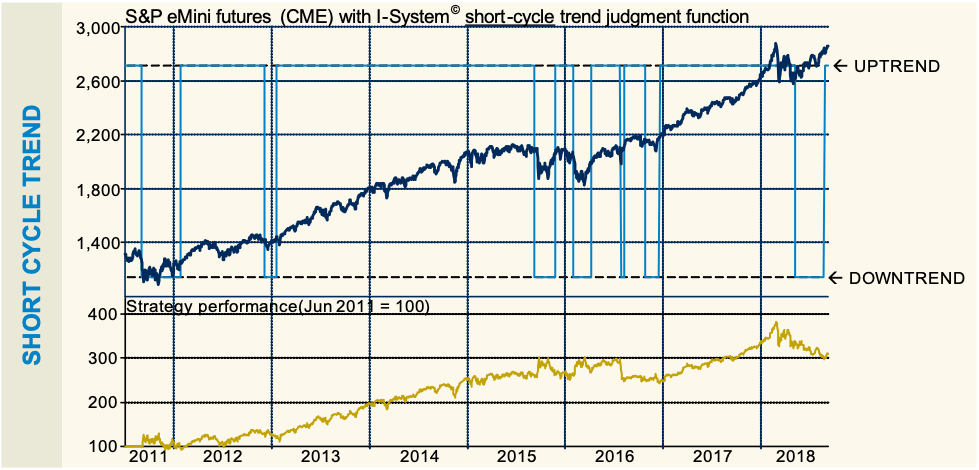

I-System’s algorithms are driven by some 70 different calculation parameters, enabling us to formulate, test and implement a large variety of intelligent trading strategies. I-System’s versatility enables us to define price trends as long-, medium-, or short-term events as the following three charts illustrate:

Furthermore, we can formulate I-System strategies either to be always in the market, or to trade more selectively, passing more time waiting for the right signals.

For every trading day and any given market, I-System strategies calculate a numerically exact measure of trend in any given market and generate buy or sell signals.

Each strategy’s simple objective is to capture value from price trends while limiting losses from adverse fluctuations. Once implemented, the strategies perform their function autonomously, reducing the complex work of daily market analysis to its final product: simple, actionable decisions. This provides investors vital decision support to navigate the market cycles confidently and profitably.

After nearly twenty years of continuous use without alterations, I-System has proven reliable, versatile, effective and cost-efficient.

I-System is reliable

We have designed I-System prototype in 1999 and have not altered its core decision-making algorithms since 2003. The model is capable of following thousands of trading strategies in hundreds of markets daily. After fifteen years of continuous use with no interruptions, code tinkering or maintenance issues, we are entirely confident that our technology is effectively model-risk proof.

I-System is versatile

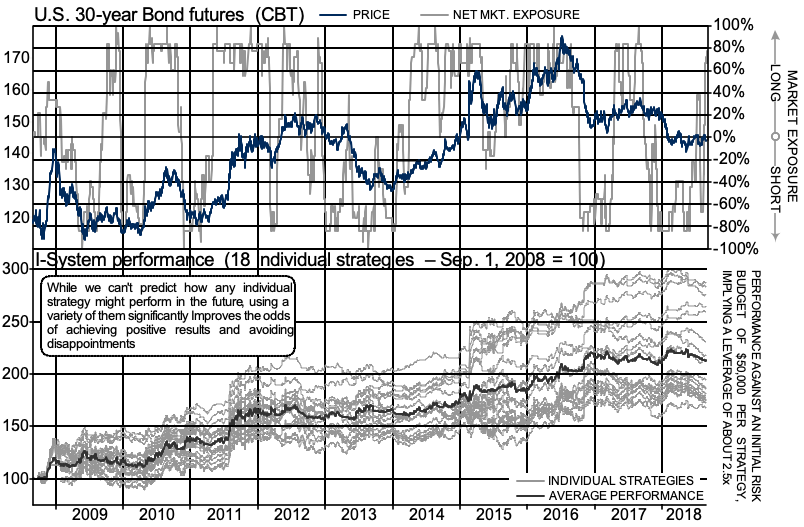

I-System can deploy multiple trading strategies in each market allowing us to offer a uniquely incremental approach to managing market exposure as the following chart illustrates:

In the top chart, we see the price of the 30-year U.S. Treasury Bond (left axis) overlaid with market exposure as a percentage of full position limit, determined by 18 individual I-System strategies (right axis). Stronger trends warrant heavier exposure, but as momentum weakens, we gradually reduce risk in accordance with specific signals generated by our strategies.

I-System is effective (our track record)

I-System’s effectiveness has been tested and proven in the most rigorous way possible: by comparing its performance to many of the world’s leading trend followers – the “managed futures” funds or Commodity Trade Advisors (CTAs).

In 2007 we set up Galstar Derivatives Trading (GDT) to manage a diversified futures trading portfolio similar to that of many typical CTAs. GDT’s trading was based exclusively on a set of some 120 I-System strategies. Between 2007 and 2013, we outperformed the index of world’s top rated CTAs, Dow Jones Credit Suisse (DJCS) Managed Futures Blue Chip index.

No lucky fluke: six years, 38 markets, 120 strategies, nearly ten thousand trades…

While the “correctness” of any single trading decision cannot be measured, Galstar track record spanned a period of six years, used 120 I-System strategies in 38 different financial and commodity markets and included close to ten thousand individual trades. This is a robust reflection of the model’s quality and effectiveness in generating profits from market trends. Our more recent results in crisis periods are detailed below.

Outperforming tail-risk funds with Altana Inflation Trends Fund

From 2011 to 2019 we used the I-System to manage a tail-event hedge portfolio under Altana Inflation Trends Fund (AITF). Over the same time period, AITF outperformed the EurekaHedge Tail Risk index.

How we navigated through various episodes of market turmoil…

Although we could enumerate dozens of similar examples, the following examples are indicative of I-System’s performance through unpredictable and unforeseen market events.

- The 2008 financial crisis: most investors sustained severe losses through 2008/09 bear market. With I-System strategies we generated substantial profits short selling the market, ending the year with a 27% positive net return.

- Late 2015/early 2016 stock market correction: at the time, equity markets shed about 15%. At that decline’s trough, Altana Inflation Trends Fund gained 19.6% net of fees.

- December 2018 market correction: when the S&P 500 dropped 9.03% AITF rose 9.98% net of fees.

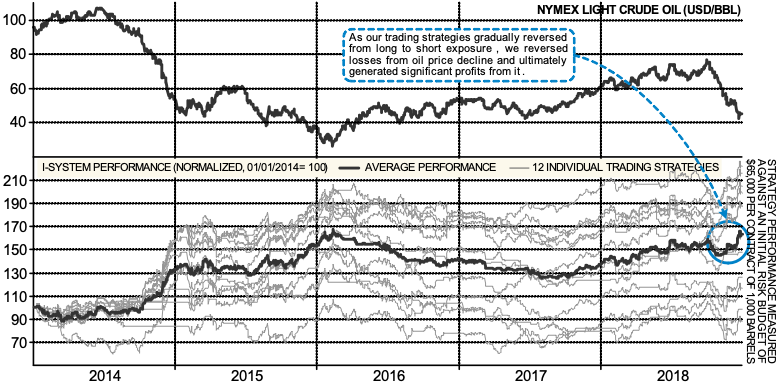

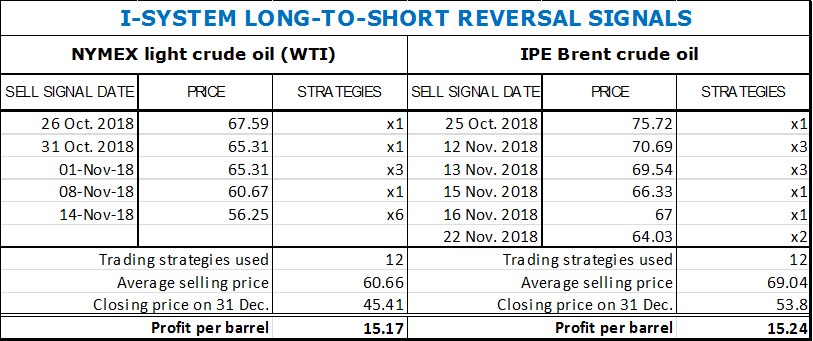

How I-System strategies navigated the 2018 oil price collapse

For commodity-related businesses, large-scale price events represent one of the greatest sources of risk. Because such events invariably unfold as trends, I-System strategies can help such firms navigate price fluctuations profitably.

A case in point was the sharp, 40% oil price collapse at the end of 2018. This event caused severe losses for a number of oil companies. Again our strategies navigated the events superbly well. The following chart shows our results trading NYMEX crude oil (WTI) futures:

Using a set of 12 I-System trading strategies we have successfully navigated the volatile price fluctuations and turned adverse oil market conditions in late 2018 to our advantage and profit. With the price correction unfolding, our strategies gradually reversed from long to short exposure, on average at $60.66/bbl on WTI and $69.04 on Brent and generated significant profits through 31 December 2018, as the following table details:

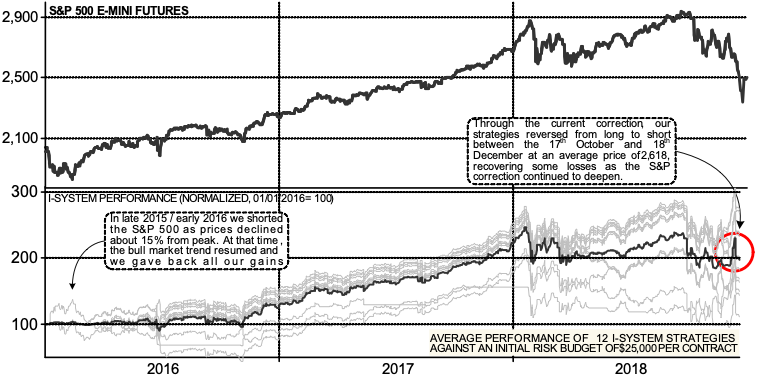

How I-System navigated the stock market turmoil at the end of 2018

I-System strategies can help investors avoid losses (and profit from) sharp equity market corrections and bear markets. As our track-record shows, we generated positive +27% net return through the last bear market in 2008.

In this sense, I-System proved its worth again when, at the end of 2018 major equity indexes declined by almost 20%. Our strategies performed as expected, generating profits in equity index futures and generating a +9.98% positive net performance for December 2018. The chart below illustrates of our trading in S&P 500 Mini futures contract:

I-System started generating sell signals on 17 Oct. at 2,816 price level. Gradually we closed out our long positions entirely and shifted to net short exposure at an average selling price of 2,618. At market close on 31 December, our short position was priced at 2,580.63 on average, implying a 75 points profit or $3,769 per contract.

These results testify to the quality of the I-System as a model and to the effectiveness of its strategies in capturing value from market trends. When a major economic crisis begins to impact securities prices – whether in financial, currency or commodities markets, I-System strategies have proven to pick up the emerging trends and trade them profitably.

Know when to get out… but also when to get back in again!

At today’s dizzying market heights, high quality decision support could prove pivotal to achieving satisfactory results through the coming turbulence. Importantly: I-System strategies can tell you when to get out – but also when to get back in again!

Screen-grab from I-System’s interface shows up-trend periods in blue and down-trend periods in red. Onset of a down-trend is a signal to reduce or hedge your market exposure. It is equally important to know when to start adding to your exposure again. During the 2008 bear market, our track record showed a 35% positive return (gross) thanks to our trend following strategies.

High quality trend following strategies can be an invaluable decision-support tool for investors and traders. Even as a way of providing a ‘second opinion’ to market analysts, such a tool provides a number of important advantages:

BENEFITS OF QUALITY SYSTEMATIC DECISION SUPPORT

| Solution to imperfect knowledge | Information overload and complexity of market analysis are reduced to simple, executable decisions: buy or sell. No need to know the future. |

| Measurable quality of decisions | Consistency and method in trading allows us to objectively measure the quality of our trading decisions |

| Discipline | Trading algorithms exclude human error like distraction and emotion |

| Absence of rogue trader risk | Rogue traders are the main cause of major trading misadventures. The risk of such mishaps is a strong deterrent for managers to explore more active approaches to investing. I-System elegantly removes this risk, replacing the human element with quantitative strategies free of human shortcomings. Like industrial robots, I-System strategies perform their tasks without mistakes. |

| Work ethic | I-System strategies never lose focus and take no days off. They also don’t demand bonus for their performance. |

| Robust performance | I-System’s unique ability to implement multiple autonomous strategies has the same effect as diversifying trading risk among many skilled traders, raising the probability that on average they will deliver satisfactory performance. |

Sign up for a one-month free trial today. Put discipline into your trading and stress out of it and navigate profitably, with confidence and peace of mind.