Quantitative easing has created multiple asset bubbles. Interest rates are near all-time lows, stocks are most overvalued ever and even assets like real estate, arts, collectibles and wine have reached record highs. But without exception, asset bubbles always burst. When they do, price corrections usually give way to sustained bear markets.

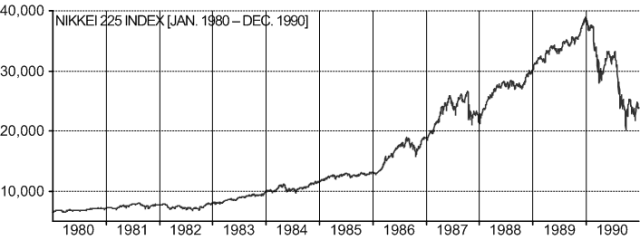

In view of the Japanification of western economies, we should revisit the precedent of Japan’s great bull market of the 1980s:

When Japanese bubble burst, the Nikkei had a two decades long bear market, dropping 82% from the December 1989 peak. More than 30 years later, it is still more than 40% below peak. But the end of the great bull runs don’t announce themselves in advance. Japan’s 1980s bull market had a number of corrections along the way – in 1984, 1986 and 1987 – but continued powering higher until its last hurrah in December 1989.

Today’s great bull market might similarly continue to rise, longer and higher than anyone could guess.

Predicting market tops is a risky business.

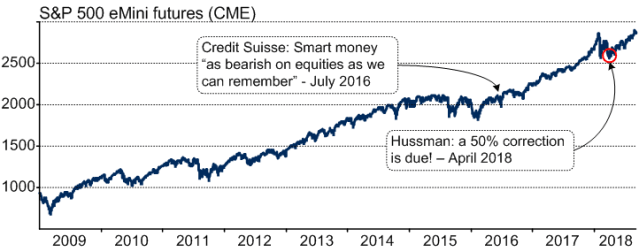

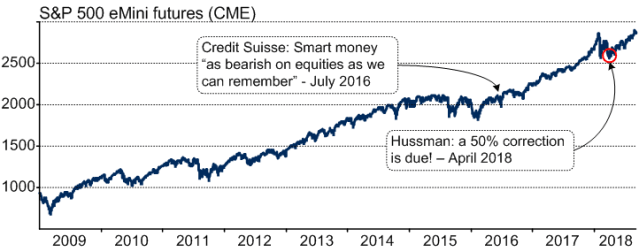

As bull markets unfold, many analysts will call tops too early. The current bull market is no different. For example, supposedly ‘smart money’ turned bearish already in 2016. At the time, Credit Suisse polled their clients and found that they were about “as bearish on equities as we can remember.”

Some two years later, in April 2018 John Hussman, one of the best respected market analysts suggested that “markets have never been this overstretched without subsequently falling by 50% or more.” Regardless, the S&P 500 continued rising for another two years, adding more than 25%.

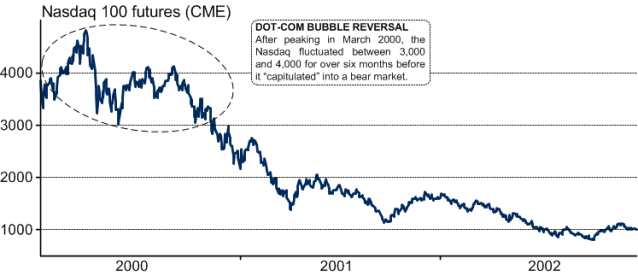

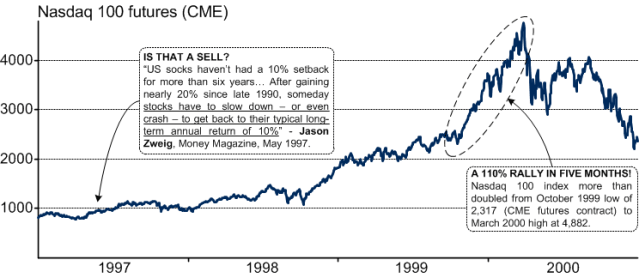

During the 1990s dot-com bubble, analysts equally warned of its ‘unsustainability’ years before the 2000 peak. In spite of that, stock prices continued rallying to new highs.

Nasdaq example shows just how risky it can be to call the top too early: in just the last 5 months of the dot-com bubble, it rose by 110%!

Navigating the roller-coaster: two key features of boom-bust cycles

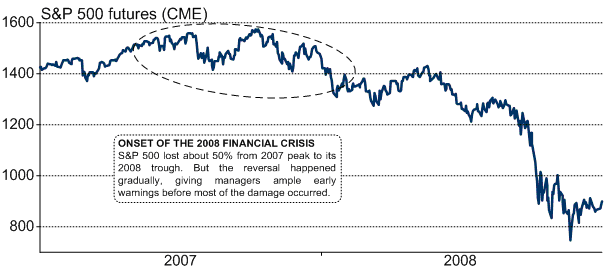

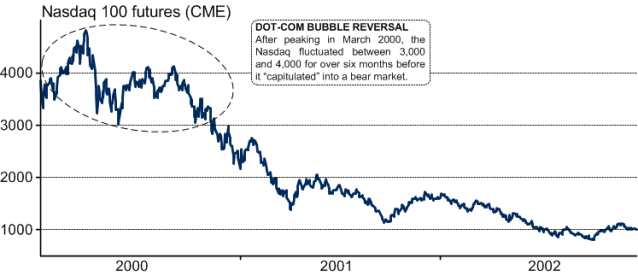

Predicting when and how the current bubble will burst is quite out of the question. But you can navigate the roller-coasters successfully thanks to two major features of the boom-bust cycles. First, reversal from bull to bear market (and back again) is a process. Second, markets move in trends.

1. Trend reversals are a process

Major trend reversals normally span a period of time – usually several months.

Forget trying to sell today’s bubble at the top. Instead, wait for the trend reversal to become apparent. You’ll have to give up some of your bull market gains, but selling before the bear market gathers momentum will protect your portfolio from a much worse decline.

2. Markets move in trends

What’s true for bull markets is also true for bear markets: they unfold as trends and span many months or even years. Thus, trend following should help you navigate the coming roller-coaster. By putting on some short trades or diversifying into commodities like Gold or Oil, you may even prosper through the equities bear market. Trend following with the I-System enabled me to generate a 35% gross return during the 2008 bear market.

Don’t become a bear market casualty. Subscribe to I-System TrendCompass reports today.

Today’s bull market could be close to peaking. Or it might add another 100% as the Nasdaq did in 1999. Rather than trying to predict, you are more likely to navigate profitably by simply following trends. For over 20 years now, I-System has proven to be a reliable and effective trends auto-pilot. Tracking a variety of long-, medium- and short-term trends in over 100 different financial and commodity markets it can provide you the same high quality guidance that’s enabled us to consistently outperform our benchmarks in the hedge fund industry, even eclipsing the performance of world’s top-rated managed futures funds.

Sign up for a one-month free trial today. Put discipline into your trading and stress out of it and navigate profitably, with confidence and peace of mind. •

The magic of market trends

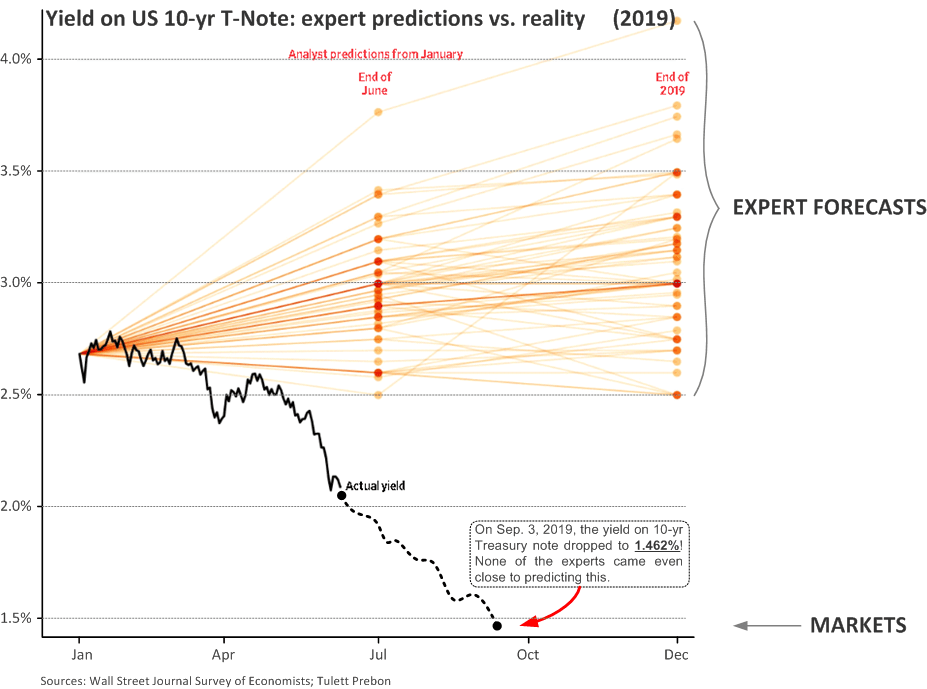

In January 2019 the Wall Street Journal polled a group of prominent market analysts, asking them to predict the yields on U.S. 10-year Treasury Notes for mid-year and the year-end. At the time, the yield was around 2.65% and most experts expected it to rise through the year. Their predictions are illustrated in the chart below, compared to the actual change in yield:

While analyst forecasts ranged from 2.5% to 4.2%, by September the yields fell below 1.5% and remained under 2% for the rest of the year. None of the experts came even close to predicting this outcome. This experience is an example of the pervasive problem in business and investing: uncertainty.

From 2011 through 2019, I managed a hedge fund portfolio for Lee Robinson’s Altana Wealth, trading in 30 different markets, including US Treasury futures. In late 2019 I reviewed the performance of my strategies and summarized the results in an article titled “How we knew yields would collapse?”

How did we ‘know’?

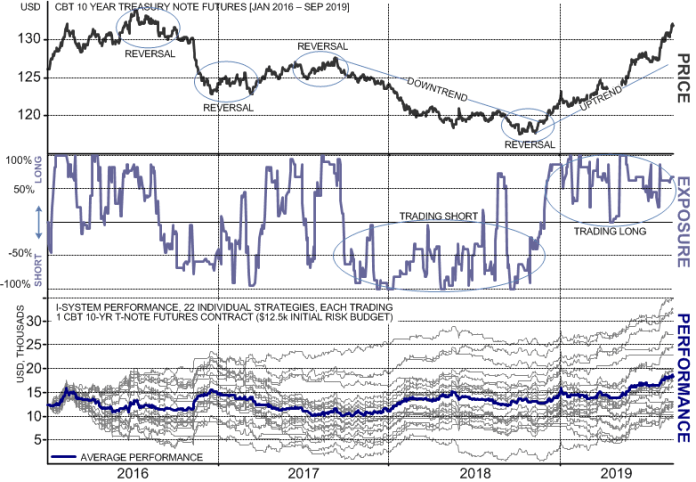

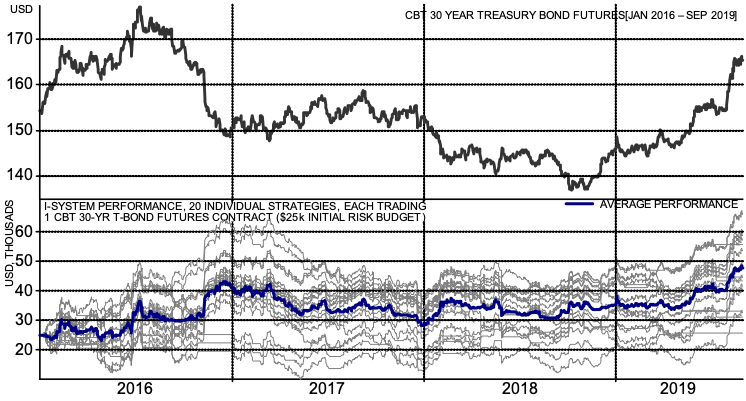

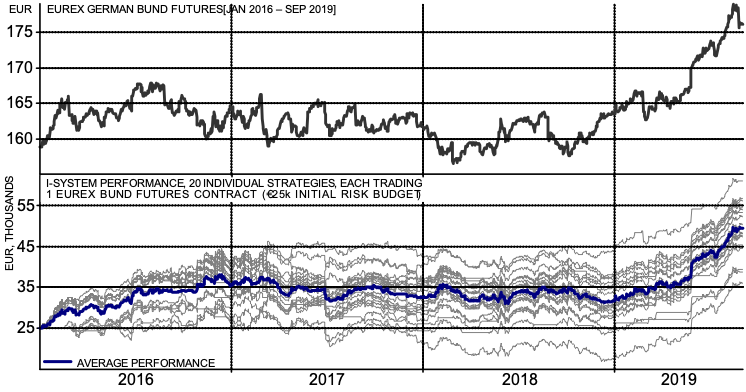

As the above chart shows, I-System strategies traded the US 10-yr Note on the short side starting in Q4 2017, then in October and November 2018 they gradually reversed to the long side and remained long through Sep. 2019, generating strong positive performance throughout. I-System generated similar results trading the 30-year Treasury Bond and the German Bund:

I was able to generate profits through both bear and bull market in bonds without needing to know anything about the economic conditions affecting the interest rates, central bank or government policies, GDP, employment, inflation, or any other factor. My performance in these markets was based entirely on the knowledge framework I had built into the I-System more than 20 years ago.

Indeed, trend following works where discretionary trading and economic forecasting fails. Rather than trying to predict the future, you are more likely to master the uncertainty of market fluctuations with a set of well-crafted systematic trend following strategies.

Subscribe to the I-System, world’s most reliable trend-following auto-pilot

For over 20 years now, we have tested the I-System in the most rigorous way possible: by trading real money portfolios. With consistent outperformance over our benchmarks we’ have proven the I-System to be a supremely reliable and effective trends auto-pilot. Tracking a variety of long-, medium- and short-term trends in over 100 different financial and commodity markets, it can provide you the same high quality guidance that’s enabled us to consistently outperform our benchmarks in the hedge fund industry, even eclipsing the performance of world’s top-rated managed futures funds.

We deliver the crystal clear daily market guidance of I-System strategies through our TrendCompass reports. Sign up for a one-month free trial today. Put discipline into your trading, stress out of it and navigate profitably, with confidence and peace of mind.

Markets move in trends – and trend followers move markets

A series of recent reports from JP Morgan, Nomura and Rabobank provided convincing evidence that CTAs can and do trigger major price moves in financial and commodities markets. CTAs, or Commodities Trading Advisors use systematic trend-following strategies to trade in a broad spectrum of markets, including bonds futures and major stock market indices.

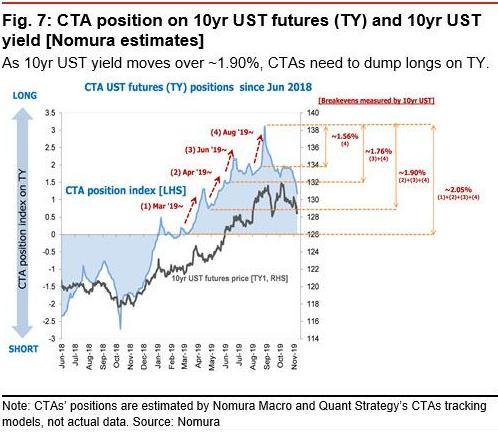

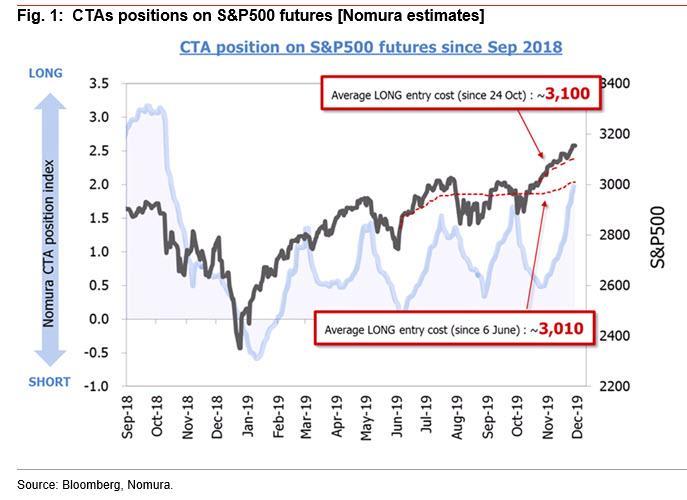

Because trend following strategies tend to be similar, when CTAs start trading into, or out of positions in some market, they often do so collectively, triggering significant price moves. Thus Nomura hypothesized that CTAs played the leading role behind the sharp yields moves in 2019 and produced this chart:

Visibly, large-scale CTA buying or selling of US treasuries seems to precede trending moves in the treasuries. As Nomura’s report found, on each occasion through 2019, CTA net buying “has been something like an opening gambit” of major market moves. Nomura also noted that the steady accumulation of long positions in US equity futures (S&P500, Nasdaq, DJIA) by CTAs has been one of the factors behind the strength of the US equity markets. The following chart illustrates the relationship:

CTAs appear to be “the main driver behind the main driver” of recent stock market moves. Rabobank’s analysts affirmed that, “CTAs have long been key in understanding price action in commodities markets,” and that understanding CTA market flows “can provide a strong edge in today’s highly systematized markets.”

Read CTAs in real time!

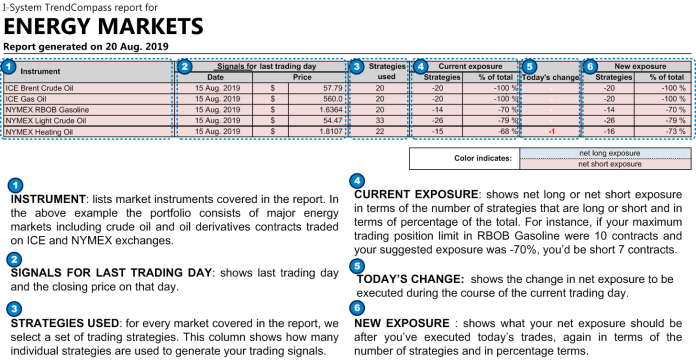

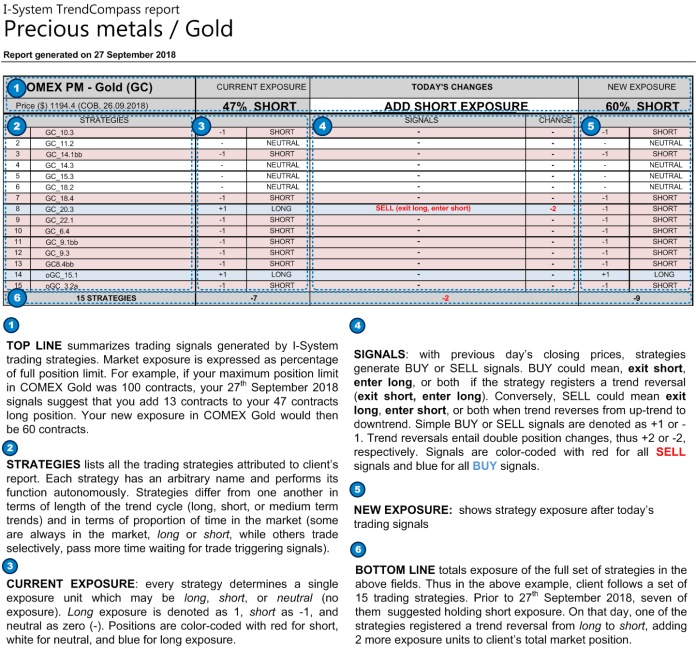

Nomura ultimately advised its clients to continue trading with the prevailing trends until CTAs show their cards… But rather than waiting for Nomura or Rabobank to report on CTA activities, you can read the “CTA cards” in real time, through our TrendCompass reports. In addition to stock indices and bonds futures, we cover over 100 markets like Oil, Gold, Silver, Copper, Coffee, Sugar and all other liquid markets in which CTAs actively trade. If you are an industry hedger, this type of decision support could be disproportionately valuable. For each market we generate daily reports based on ten or more I-System trend-following strategies similar to the ones typically used by leading CTAs.

What you get every day:

We worked hard to make the TrendCompass reports as intuitive and easy to read as possible. Almost without exception, our clients agree: they could not be any clearer. You’ll need no more than 30 seconds a day to know how to navigate the markets you trade. Each report consists of a portfolio summary page and one page per each market included in your reports:

(1) The portfolio summary page

Subscribe today and take a one-month free trial with no further obligation

Take a one-month free trial today. Put discipline into your trading, stress out of it and navigate profitably, with confidence and peace of mind.

Alex Krainer is the creator of I-System technology, founder of TrendCompass.net and a former CTA hedge fund manager based in Monaco. Alex wrote the 5-star rated book “Mastering Uncertainty in Commodities Trading”.

Leave a reply